A man from Waukesha, Wisconsin was prescribed a life-saving medical device after a heart attack, but his insurance provider denied coverage after deciding the device was “not medically necessary.”

Dan Saccomando, who survived a heart attack at 47, wore the ZOLL LifeVest, a wearable defibrillator, every day. He was told the device would act as a fail-safe until he was able to have a cardioverter defibrillator implanted in his chest, as the vest is designed to deliver shock treatments when the patient’s heart begins to fail.

“I’d rather have the chance to live than not,” Saccomando told Fox 6.

Even though the device costs between $2,000 and $3,000 a month, he wore the LifeVest for more than six months between his heart attack in May and his ICD surgery Dec. 6.

SIGNS OF HEART ATTACK EVERYONE SHOULD KNOW

An image illustration provided by ZOLL shows how the LifeVest, a wearable defibrillator, is worn by patients.

(ZOLL LifeVest)

Saccomando’s insurance, Anthem Blue Cross and Blue Shield, denied coverage for the LifeVest.

In a statement to Fox 6, the company said:

“While Anthem Blue Cross and Blue Shield does cover wearable cardioverter defibrillators in certain situations, medical research and current standards of care to not support the use of these devices following a heart attack, and they are not covered under Anthem’s medical policy in cases such as this one.”

The company reportedly added that it empathizes with Saccomando and understands his “point of view,” but its policy is consistent with “those across the industry,” including Medicare.

Anthem released its policy, which explains its reasoning behind stating that the device is “not medically necessary” in Saccomando’s case. Citations to medical studies that support the company’s decision are included in the document.

Medicare also released its policy on wearable defibrillators to Fox 6, which is similar to Anthem’s.

CHRISTMAS EVE IS GREATEST RISK FOR HEART ATTACK, STUDY CLAIMS

FILE – The headquarters of Blue Cross Blue Shield health insurer Anthem Inc. is seen in Indianapolis, Ind.

(A.J. Mast/Getty Images)

Records show the ZOLL LifeVest was approved by the FDA for the first time in early 2002. As of right now, it is the only wearable defibrillator on the market, though other devices are being developed.

Dan Sorajja, a cardiac electrophysiologist at the Mayo Clinic, told Fox 6 he disagrees with the number of insurance denials and wants to see more providers approve coverage for the LifeVest.

“The device is pretty commonly prescribed,” he said. “This LifeVest is kind of that bridge … to get you to that point where you can get a permanent defibrillator.”

Sorajja is a big supporter of wearing the device after a heart attack. He said there is research showing the device can reduce a patient’s chances of dying, especially for those who recently suffered a heart attack and are at a higher risk of sudden cardiac arrest while waiting for their heart pumping function to improve enough for surgery.

HEART ATTACK RISK CAN BE FOUND THROUGH NON-INVASIVE CALCIUM SCORE SCREENING SCAN

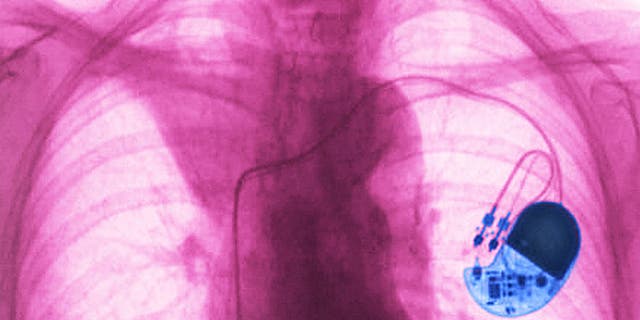

Pacemaker implanted in the chest. Frontal chest x-ray.

(Cavallini James/BSIP/Universal Images Group via Getty Images)

Dalip Singh, a cardiologist at the Milwaukee VA Medical Center, also told Fox 6 he supports the use of the LifeVest after a heart attack when pumping function is weak. He said most patients do get better by using the device. If they don’t, that’s when they are given a permanent defibrillator.

Within the past three years, Singh said he has had at least two patients receive a shock treatment from the device. He said they most likely would have died without it.

Saccomando told Fox 6 he is “disheartened by the denial,” but is considering filing one last external appeal with Anthem.

CLICK HERE TO GET THE FOX NEWS APP

When a health insurer decides a medical device or says the procedure is unnecessary and denies coverage, consumers should contact their doctor’s office to seek advice. The office might be able to send the insurance company more documentation or re-submit the request under a different medical code.

An appeal can also be filed with the insurer. If that doesn’t work, complaints can be filed to the state’s insurance commissioner’s office.

Fox News Digital reached out to ZOLL for a statement, but did not hear back. A public relations manager told Fox 6 that employees do not give interviews or provide comments.