Inflation’s impact may even go beyond the immediate pressure on Americans’ pocketbooks, to a larger sense that it is stifling opportunity in America and the deeper sense that the nation’s economic troubles of recent years have been, as a whole, tougher than others it has faced in generations.

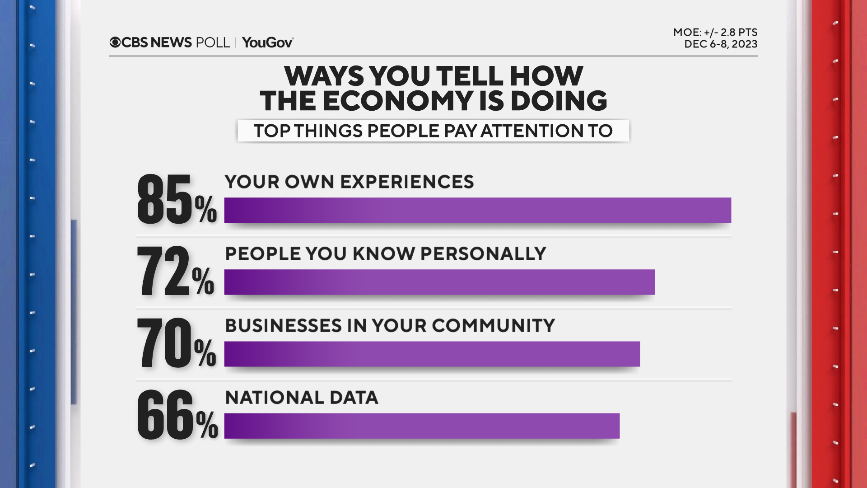

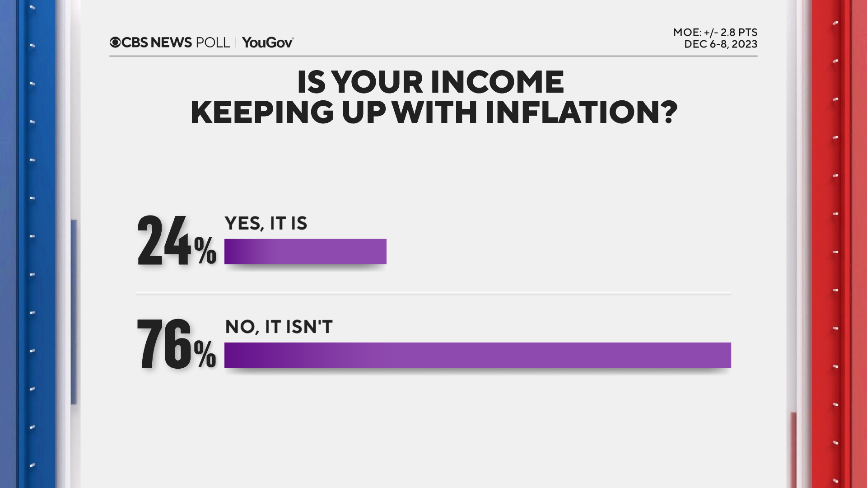

So, even amid stronger jobs reports and economists’ talk of “soft landings,” people say they still pay more attention to their own experiences than to macroeconomic measures — and an overwhelming number say their incomes aren’t keeping pace.

More people today say their standard of living is worse, not better, than their parents’ was, and it’s age group encompassing a lot of millennials and Gen-Xers, currently in their prime working years, who are especially apt to think so — a sentiment that runs counter to the traditional notion of the American Dream.

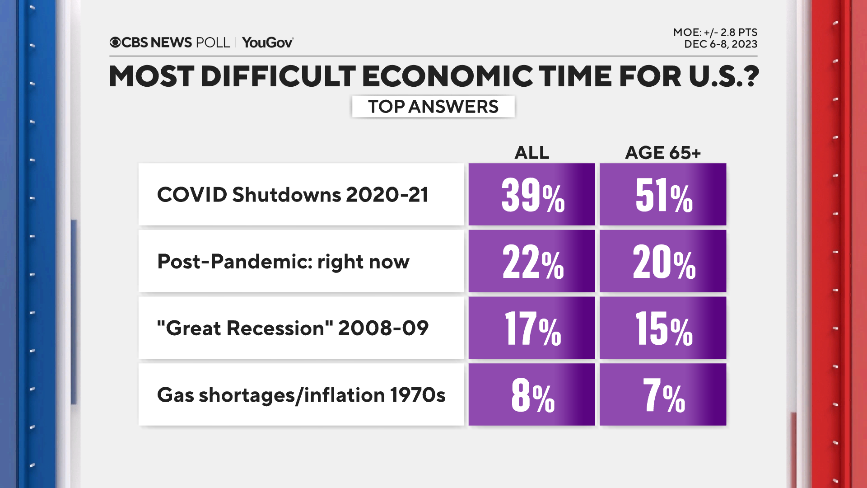

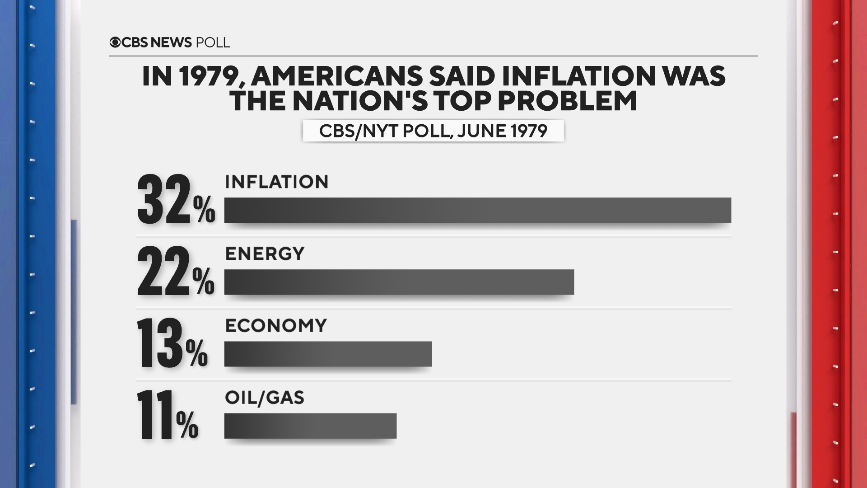

It’s been four decades since Americans have seen inflation like they have in recent years. When asked to put current troubles in context, Americans say the economic difficulties arising out of the pandemic have been the worst in a couple of generations, more so than the crash and Great Recession of 2008-09, other recession periods in the 90’s and 80’s, and more so than the inflation and gas shortages of the 1970s.

Today will surely be fresher in mind and bring some recency effects here, but it does underscore the fact that many adults have not been through this kind of inflation before. (And for those over 65, who were adults in the 1970s, the country’s more recent difficulties stand out for them, too.)

The “disconnect” between micro and macro?

For months, the nation’s traditional “macro” numbers like job growth and employment, GDP and even the rate of inflation have often shown signs of strength or improvement.

So, we just asked directly what they pay attention to — and people say they pay more attention to personal experience than to these kinds of economic figures.

And the job market may be strong, but an overwhelming three-quarters feel their incomes aren’t keeping up with inflation.

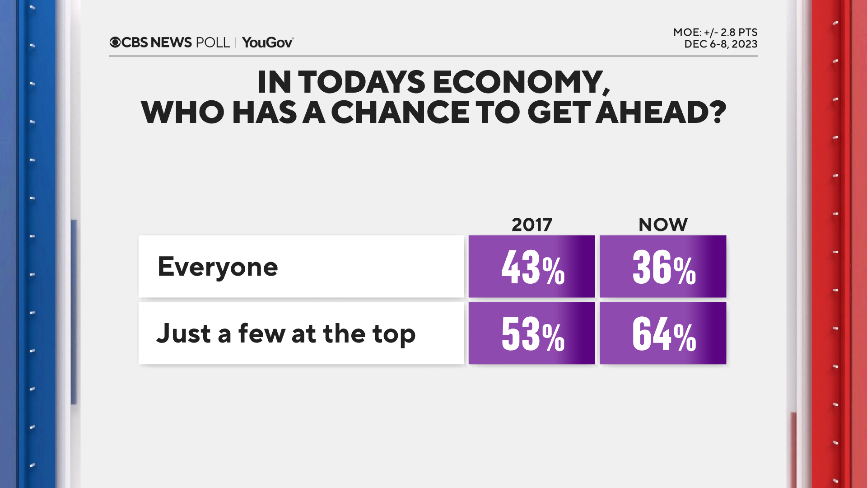

There’s a prevailing feeling that opportunity is only increasing for the wealthy, not the middle class. In all, Americans have voiced skepticism about unequal opportunities for a while, but today the larger idea that “everyone has a chance to get ahead” is down compared to before the pandemic.

So what can we do?

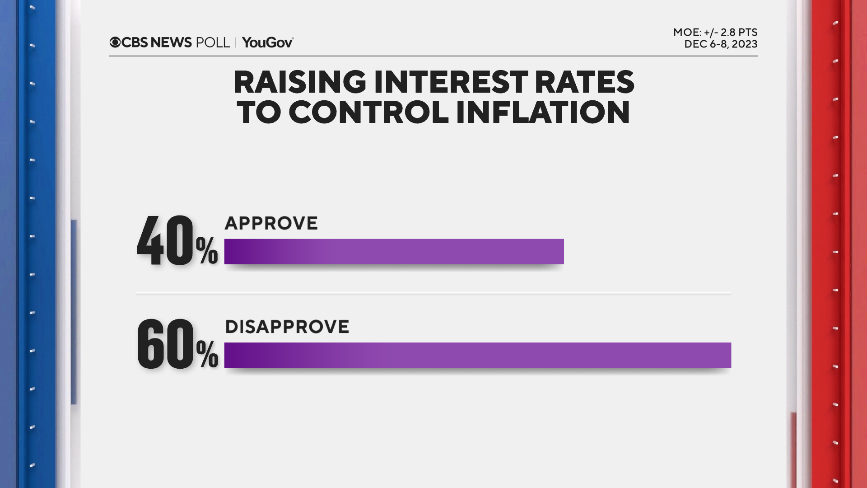

More interest rate hikes aren’t a broadly popular idea for controlling inflation — they’re especially unpopular with people in the lowest income bracket.

Nor are Americans willing to see unemployment go up (perhaps a consequence of higher rates) if that meant dampening inflation.

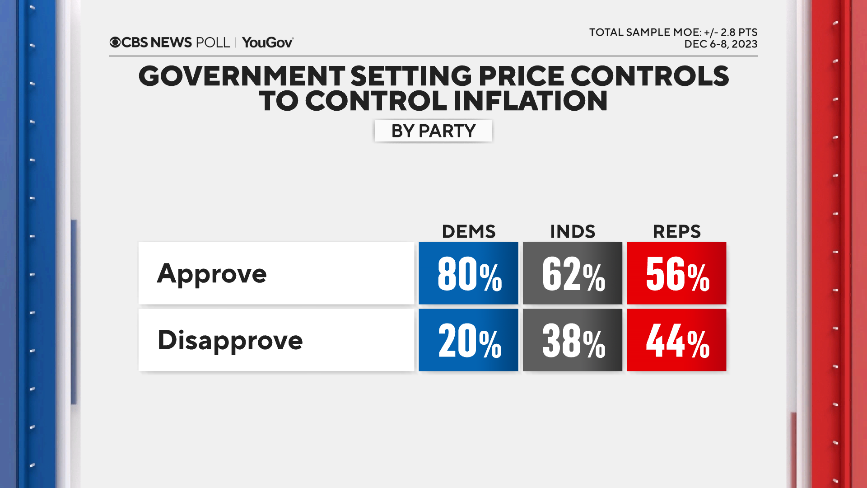

Back in the late 1970’s when the nation was facing high inflation, the CBS News poll was asking about it, and asked about the idea of government price controls. So we asked a similar question now — and found that most would support the (very hypothetical) idea.

Price control support includes big numbers of Democrats and though the party might be associated with a more free-market approach in the public mind, more than half of Republicans support it, too.

What does this mean for the White House?

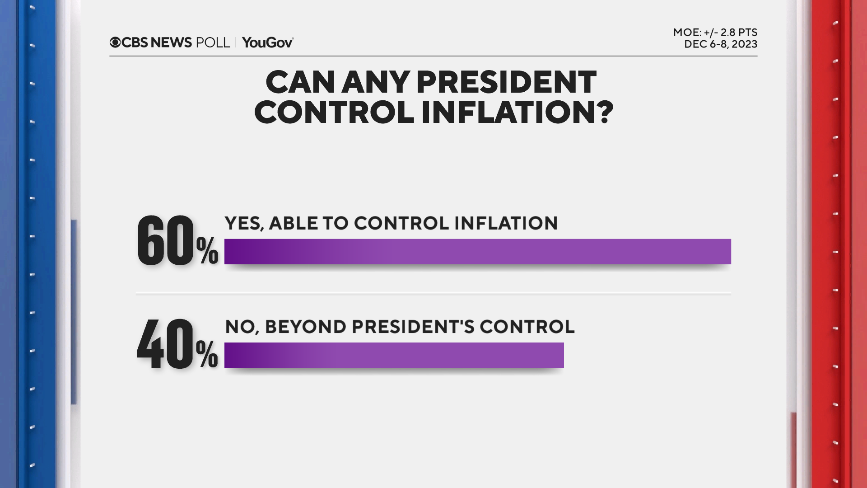

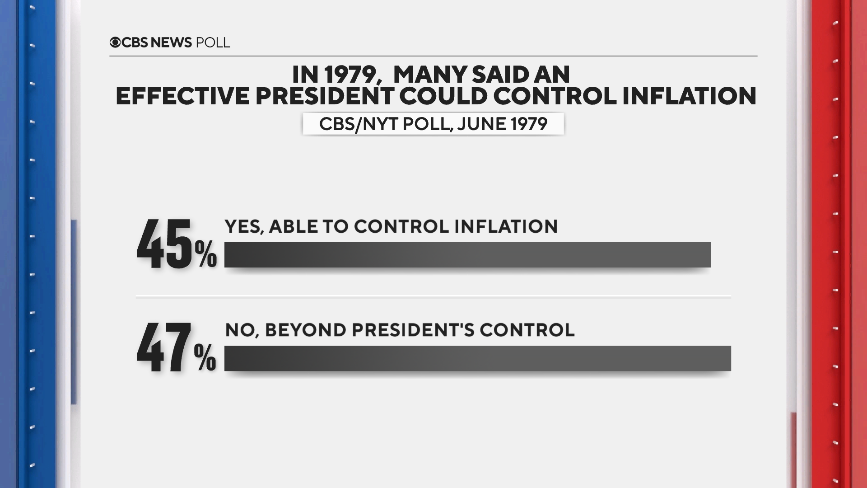

Most Americans do think a president can control inflation.

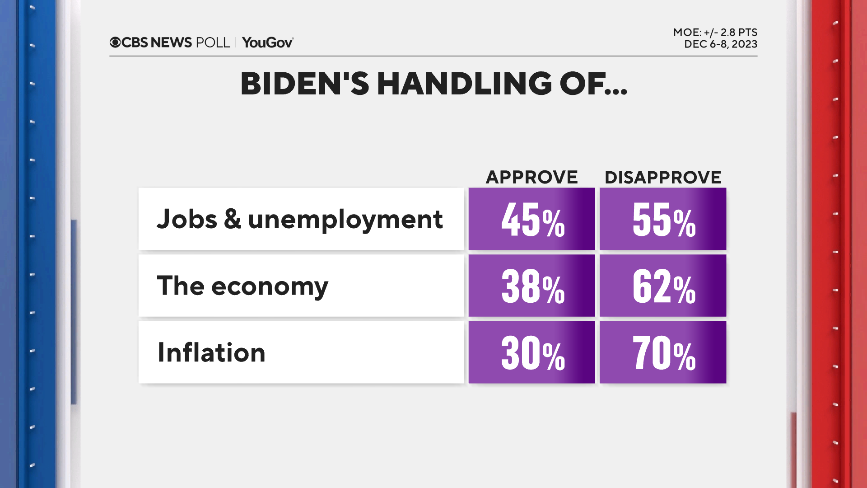

For some context, in somewhat similar questions from the 1970s and 80’s, many thought so then, too. Given the complexity of the world’s economy — and that people do recognize multiple reasons for inflation — they may or may not be making accurate reads of the office’s power. But either way, so long as inflation is high, that could be one reason President Biden continues to get poor marks on his handling of it.

People don’t blame themselves for inflation in the form of “higher consumer demand.” Their main causes point further afield, to international factors, suspicion of companies overcharging and government spending.

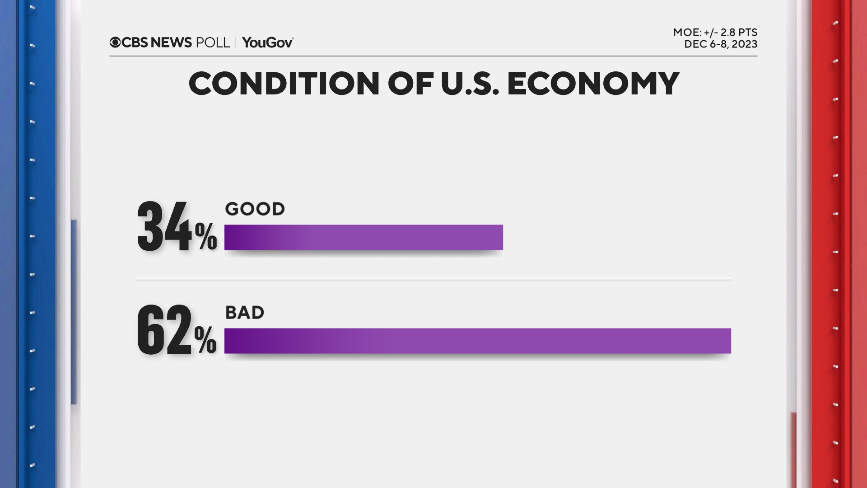

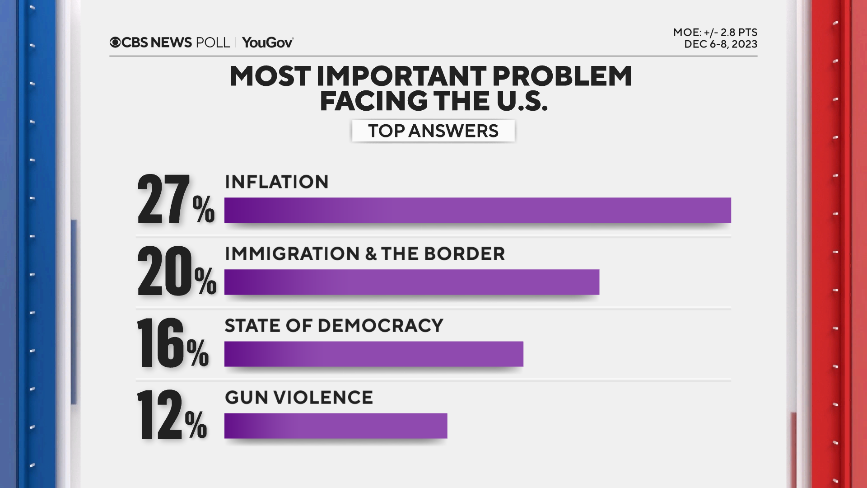

Inflation remains the top reason people say they feel the economy is bad, when they do. Views of the economy, overall, are still broadly negative (though a lot of that is driven by partisanship, too) and closer again to where they were this spring than this fall. The pattern this year has been the number saying “bad” floating around in the low to mid-60’s; perhaps reflective of some ongoing uncertainty about its overall outlook.

Mr. Biden still gets large disapproval for handling inflation and Americans are still more apt to think his administration’s actions have led to it growing, not slowing.

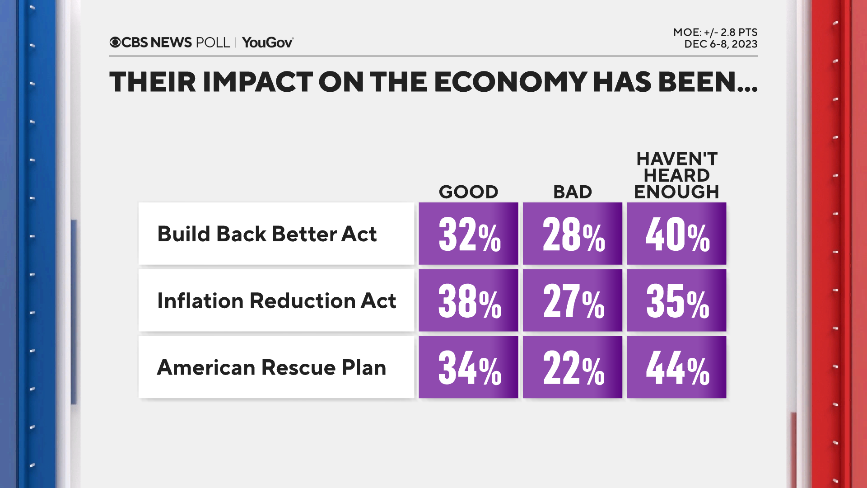

The Biden administration often touts its legislative record on the economy, but Americans’ evaluations of things like the Build Back Better Act and the Inflation Reduction Act are mixed. Many, including in the president’s own party, say they have not heard enough about them, at least not by name.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,144 U.S. adult residents interviewed between December 6-8, 2023. The sample was weighted according to gender, age, race, and education based on the U.S. Census American Community Survey and Current Population Survey, as well as past vote. The margin of error is ±2.8 points.

In the CBS News polling referenced from 1979 and 2017 the interviews were conducted with respondents by telephone using RDD samples. The most important problem item from 1979 was coded at the time from open-ended responses.