Never mind the macro stats for the U.S. economy — Americans are hot, and very much still bothered by high prices, with recent reports about GDP growth, stock gains and a strong labor market apparently providing cold comfort. At least so far.

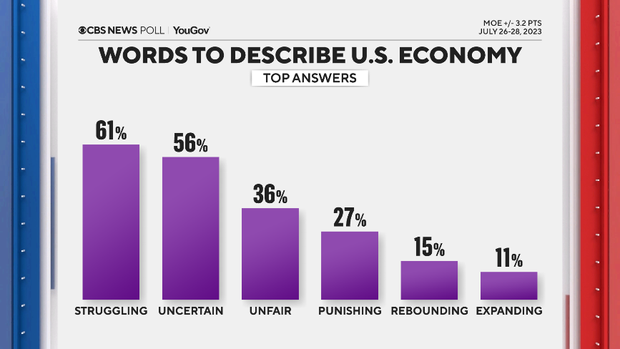

Instead, most describe the economy as “uncertain,” along with calling it bad, and “struggling” but not improved.

So, there’s plenty of lagging skepticism hanging over the public mind after the turmoil of recent years and months of chatter about a potential recession. Almost no one is calling things “stable.”

And that’s the case despite relatively good feelings about the job market and job security.

It’s not just whether one has a job, but what your wages can buy you. Most of those working say their pay is not keeping pace with rising prices.

(The fact that most report paying higher electric bills and being forced indoors because of the heat waves may not be helping the mood either.)

And even if the rate of inflation is slowing, those price hikes have clearly left their mark.

Prices are the No. 1 reason people give when asked why they call the economy bad and the top reason given when they describe their personal financial situation as bad.

Interest rates, they report, are also a net-negative on their collective finances. Most, particularly younger people, report it’s harder to buy a home than for past generations.

It all adds up to most feeling they’re staying in place financially but not getting ahead, and many feeling that they’re falling behind and concerned about affording things now and retirement in the longer term.

As is often the case in these kinds of economic evaluations, what people see at the cashier, or on their bills on the kitchen table, has outsized impact over more abstract economic reports.

Here’s that comparison: Americans rate the job market stronger than the overall economy.

But many still think the prices they pay are going up. That may comport with macro data saying inflation is slowing, but price increases are still felt by consumers.

The politics

There’s plenty of skepticism about help from political leaders on either side of the aisle. It isn’t good news for the president.

Most tie both the U.S. economy and their own personal finances (whether bad or good) at least in part to President Biden’s policies — an important measure of both macro and micro connection — and also to that very immediate measure of prices.

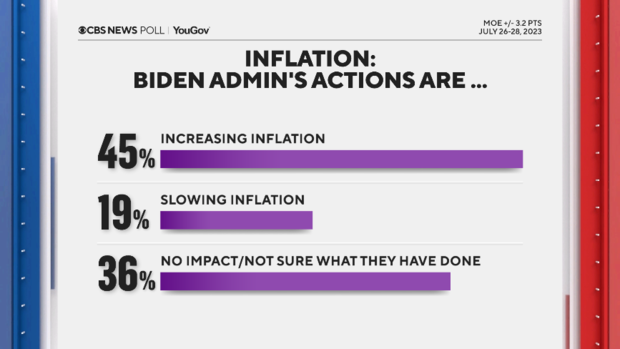

Most don’t think the Biden administration is lowering inflation — another key metric to watch in coming months — and even fewer think congressional Republicans are taking actions that do so, with many not sure what they’ve done. As they campaigned to win the House majority last year, most voters expected them to prioritize dealing with inflation.

(For that matter, just a quarter think the Federal Reserve’s actions have lowered inflation, though many aren’t sure what it has done.)

The race to define “Bidenomics”

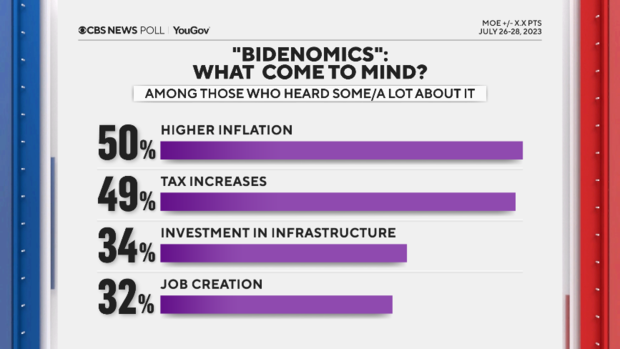

This also shows the challenge President Biden faces in his latest push to get the public to reconsider not just how they think of the economy, which few describe as “rebounding,” but also the meaning of the phrase his administration has coined, “Bidenomics.”

It is not, as of yet, a widely known term by any means.

The people who say they have heard something of the term skew Republican right now. So, to many of them, it looks more pejorative. Half say they equate it with “higher inflation” and even “tax increases,” by far the top two items chosen. That said, most independents also mention those two items first.

Democrats are more positive — if they’ve heard of it — so the president at least has some building blocks with his base. Majorities of them say it means “job creation,” “investment in infrastructure,” “help for the poor” and “the middle class” to them.

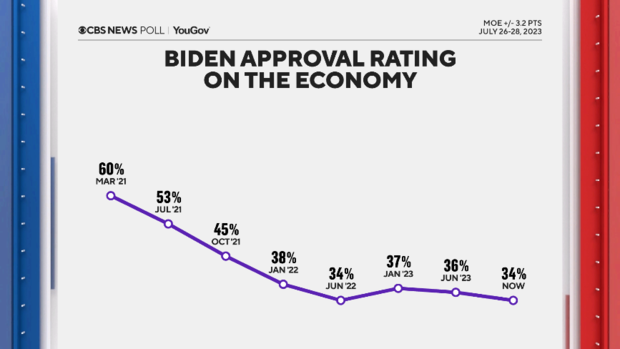

But this economic mood keeps weighing on the president’s overall numbers. His handling of the economy is as low as it’s been, along with his overall approval rating too, which has been hovering in the low-40s range for more than a year, now down to 40%.

The heat

And yes, most Americans are hot and report feeling unusually high temperatures in all regions of the country, as much of the U.S. sets heat records. They’re coping by staying inside more, keeping their kids inside and economically, one impact they report is having to pay higher electric bills.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,181 U.S. adult residents interviewed between July 26-28, 2023. The sample was weighted according to gender, age, race, and education based on the U.S. Census American Community Survey and Current Population Survey, as well as past vote. The margin of error is ±3.2 points.