The House Ways and Means Committee on Friday released a partially redacted version of former President Donald Trump’s tax returns, completing a longtime objective of Democrats to make Trump’s finances public after the former president unsuccessfully tried to stop them in court.

The financial documents cover six years of Trump’s individual returns filed jointly with his wife, Melania, including his time in the White House. The document dump also includes tax forms for several of Trump’s business entities that were investigated by Ways and Means Democrats, a report from the Democratic majority, and a response by Republicans on the committee. There are nearly 6,000 pages of material, including 2,700 pages of individual returns and more than 3,000 pages from Trump’s businesses.

The tax forms provide insights into the state of Trump’s finances from 2015 to 2020 as he mounts a third bid for president in 2024. The redactions hide personal sensitive information such as Social Security and bank account numbers.

The committee voted 24 to 16 along party lines to release Trump’s tax returns last week. Democrats argued that transparency and the rule of law were at stake, while Republicans countered that the release would set a dangerous precedent with regard to the loss of privacy protections.

JANUARY 6 COMMITTEE WITHRDRAWS TRUMP SUBPOENA: ‘THEY KNEW I DID NOTHING WRONG’

Former President Donald Trump arrives to speak at an event at Mar-a-Lago in Palm Beach, Fla., on Nov. 18, 2022.

(AP Photo/Rebecca Blackwell, File)

House Ways and Means Committee Chairman Richard Neal, D-Mass., center, talks to the media after the committee voted on whether to publicly release years of former President Donald Trump’s tax returns during a hearing on Capitol Hill in Washington, D.C., on Dec. 20, 2022.

(AP Photo/J. Scott Applewhite, File)

Trump had refused to release his returns when he ran for president and had waged a legal battle to keep them secret while he was in the White House. But the Supreme Court ruled last month that he had to turn them over to the tax-writing Ways and Means Committee.

“The Democrats should have never done it, the Supreme Court should have never approved it, and it’s going to lead to horrible things for so many people. The great USA divide will now grow far worse,” Trump said in a statement after his tax information was made public.

“The Radical Left Democrats have weaponized everything, but remember, that is a dangerous two-way street! The ‘Trump’ tax returns once again show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises,” he added.

Read Trump’s IRS Form 1040 filing from 2017:

Ways and Means Committee Democrats released a report on Trump’s taxes last week that showed the former president paid little to no federal income taxes on his multimillion-dollar income from 2015 to 2022, as he claimed millions in business losses.

DEMOCRATS RELEASE REPORT ON TRUMP TAX RETURNS, REVEALING INCOME, TAXES PAID, IRS AUDIT

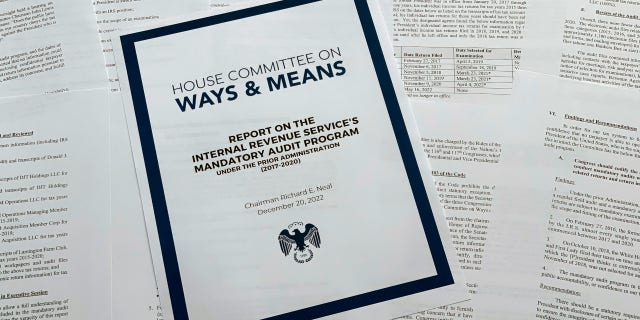

The report from the House Ways and Means Committee regarding the IRS and former President Donald Trump’s tax returns is shown on Dec. 21, 2022.

(AP Photo/Jon Elswick, File)

The analysis within the reports conclude that any lack of proper taxation on Trump’s earnings appears to have been ultimately a failing of the IRS and not the result of pressure or obfuscation from the White House.

Trump’s family of enterprises used reported losses, foreign tax credits, deductions, charitable donations and many other financial maneuvers to great effect in offsetting taxation on profits.

These business tactics frequently shrank his otherwise sizable tax requirements down to miniscule amounts — sometimes under $1,000, according to the committee.

VOTERS WANT OUT WITH THE OLD, IN WITH THE NEW FOR PRESIDENTIAL CANDIDATES IN 2024 ELECTION: POLL

Ways and Means Republican Leader Rep. Kevin Brady, R-Texas, blasted the release of Trump’s tax information Friday.

“Democrats have charged forward with an unprecedented decision to unleash a dangerous new political weapon that reaches far beyond the former president, overturning decades of privacy protections for average Americans that have existed since Watergate,” Brady said in a statement.

“Going forward, all future Chairs of both the House Ways and Means Committee and the Senate Finance Committee will have nearly unlimited power to target and make public the tax returns of private citizens, political enemies, business and labor leaders or even the Supreme Court justices themselves,” he warned.

Fox News’ Timothy Nerozzi and The Associated Press contributed to this report.