Expenses at Caesar Rodney School District are outpacing revenue.

This month the district is asking residents to approve raising school taxes 27.7%, spread over three years, in a referendum vote. The levies would help fund utilities, maintenance, building budgets and staffing.

But while these administrators have to balance budgets, improve school facilities and keep pace with growth, many residents are already bracing for possible tax hikes in the wake of Delaware’s first property reassessment in decades.

Caesar Rodney says the increase — the largest set to come before reassessment results — is needed to support key projects and operating costs.

The last similar request was approved by voters in 2015. Between 2002 and that decision, voters rejected three other proposals from the Kent County district. Now, this one is slated to reach voters on April 22.

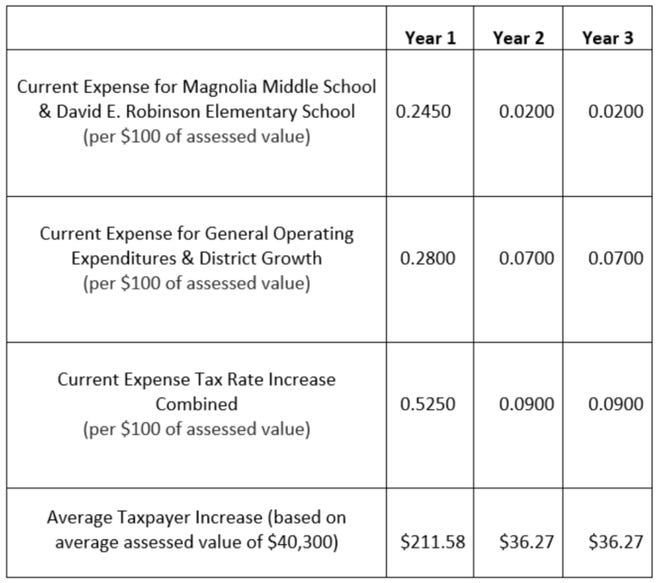

For the average taxpayer owning a house with an assessed value of $40,300, taxes would increase by $211.58 in 2024 and another $36.11 in 2025 and 2026, according to the school district’s breakdown.

But convincing voters to agree might be a challenge.

Breaking down Caesar Rodney’s referendum hopes

Quality teachers, school theater programs, junior ROTC, student bussing, a culinary arts track — Superintendent Christine Alois opened an informational meeting Wednesday evening with a slide show.

“All of these things come at a price,” she told the auditorium, addressing a small group gathered to discuss the referendum.

Her system has grown by over 500 students since the last referendum. Inflation is tightening budgets across the board. And the system already hosts the smallest per-pupil revenue among Kent County districts, Alois said.

“With rising costs for both facilities maintenance and general operating expenses, the district is reaching out to the community to support an increase in revenue collected,” Alois said in a statement earlier this month. “Having financial stability will allow the district to maintain quality educational opportunities, award-winning programs, safe and modern facilities and continue to recruit and retain qualified and dedicated educators.”

Delaware allows residents within a school district to vote on proposed changes to the operating expense tax and debt service tax — two taxes that form the overall school tax that property owners pay. Residents don’t have to own property themselves or have students in schools to cast a vote. These taxes generate money for school operations and capital improvements.

Now the April 22 referendum will come with three items focusing on capital improvement and operating costs. At a glance:

- HVAC systems at Magnolia Middle School need total replacement. Well past its useful life, according to the district, this 25-year-old system must be replaced at nearly $14 million.

- If voters reject these tax increases, the district would not receive any state funding share — over $11 million of the projected cost.

- Magnolia Middle and David E. Robinson Elementary schools were opened in fiscal year 2022 with no additional operating revenue. Costs like utilities, maintenance, building budgets and staffing need to be considered, the district said.

- Caesar Rodney also hopes to keep pace with its district’s growth and further expansion — aiming to maintain a 1:1 device-to-student ratio, meet increased payroll expenses, as well as covering heightened transportation operations and more.

Aren’t my property taxes already going up?

Maybe, maybe not.

The First State is coordinating a statewide reassessment of property values both residential and commercial for the first time since the 1980s.

Data collection began in 2021 after a judge ruled Delaware’s property tax system was unconstitutional. Kent and Sussex counties are now set to release finalized reassessments by 2024, while New Castle eyes 2025. All three counties hired the firm Tyler Technologies to carry out the assessment. And for Kent, initial or tentative notices of new property values are expected this year.

“When people get their reassessment notice they will have some sticker shock,” said Mitch Wilson, senior manager with Invoke Tax Partners’ property tax office. “Because they’re cognitive of their current assessment, what it’s been forever and ever. You’re going to see a change.”

Also from 2020: School funding 101 –How a major settlement does (and doesn’t) change how Delaware pays for its schools

Bringing the system in line with the law meant counties had to reassess property values to tie them closer to their present market value. Then, both school districts and counties must dial back their corresponding tax rates to bring in the same money — or in some situations, a bit more — as before.

The common wisdom, reported in 2020, was that likely a third of tax bills could go up, a third could stay the same and another third could go down. For his part, Wilson expects some taxpayers to see their bills rise as much as 10%.

This Caesar Rodney referendum hopes for about 52 cents on every $100 of assessed value in fiscal year 2024, if referendum items pass, then 9 cents for the next two years.

“If the county plans currently hold, the first year of the CRSD proposal would not be impacted by reassessment,” Superintendent Alois said via email. With those results likely coming by July 2024, that would tail fiscal year 2025 in Delaware.

As it relates to the reassessment itself, “the district will remain revenue neutral,” Alois said. “Residents may feel free to reach out for us to help connect them to Tyler Technologies for additional information.”

The district understands upcoming reassessment results loom on the mind. Regardless, they say the funding is pivotal.

“If the effort does not pass,” Alois added, “the issues of maintenance and operational needs will not go away.”

Looking for more information?

More can be found on the district webpage dedicated to the proposal. The district said Tyler Technology also offered to connect with interested residents.

April 22 voting locations will be Allen Frear Elementary School, W. Reily Brown Elementary School, Fred Fifer III Middle School and J. Ralph McIlvaine Early Childhood Center from 7 a.m. to 8 p.m. Homeowners age 65 or over are eligible for a tax credit against regular school property taxes in Delaware at 50%, or up to $500.